Whereas Aptera Motors continues to push ahead with its production-intent (PI), photo voltaic EV builds forward of manufacturing plans (hopefully) subsequent yr, and its timeline for preliminary buyer deliveries is as cloudy as ever. The SEV startup quietly up to date the estimated supply timelines for all reservation holders, giving us an concept of the place it stands when it comes to scaled manufacturing. Nevertheless, in talking with Aptera, a number of these numbers (for higher or worse) rely on very important funding that has but to be secured – a standard theme within the startup world.

Aptera Motors is the final of the residing photo voltaic EV startups and one we’ve adopted carefully for a number of years as a result of its distinctive method to sustainable mobility has the potential to sooner or later reimagine and elevate your complete automotive trade.

To get there isn’t any small feat, and Aptera Motors is already on its second life in reaching the holy grail of scaled photo voltaic EV manufacturing. By means of our protection and constant, clear updates from Aptera Motors immediately, we’ve discovered simply how a lot progress the startup has made in the previous couple of years and, conversely, simply how a lot additional it might want to go to show viable.

As it’s with any startup, the largest hindrance to fast growth has been funding. For a protracted whereas, Aptera leaned on its loyal base of followers and reservation holders, who invested their very own cash for an opportunity at one of many first 2,000 Launch Version photo voltaic EV deliveries. The corporate ended up elevating an inspiring $135 million from over 17,000 buyers – probably the most profitable crowdfunded increase in historical past.

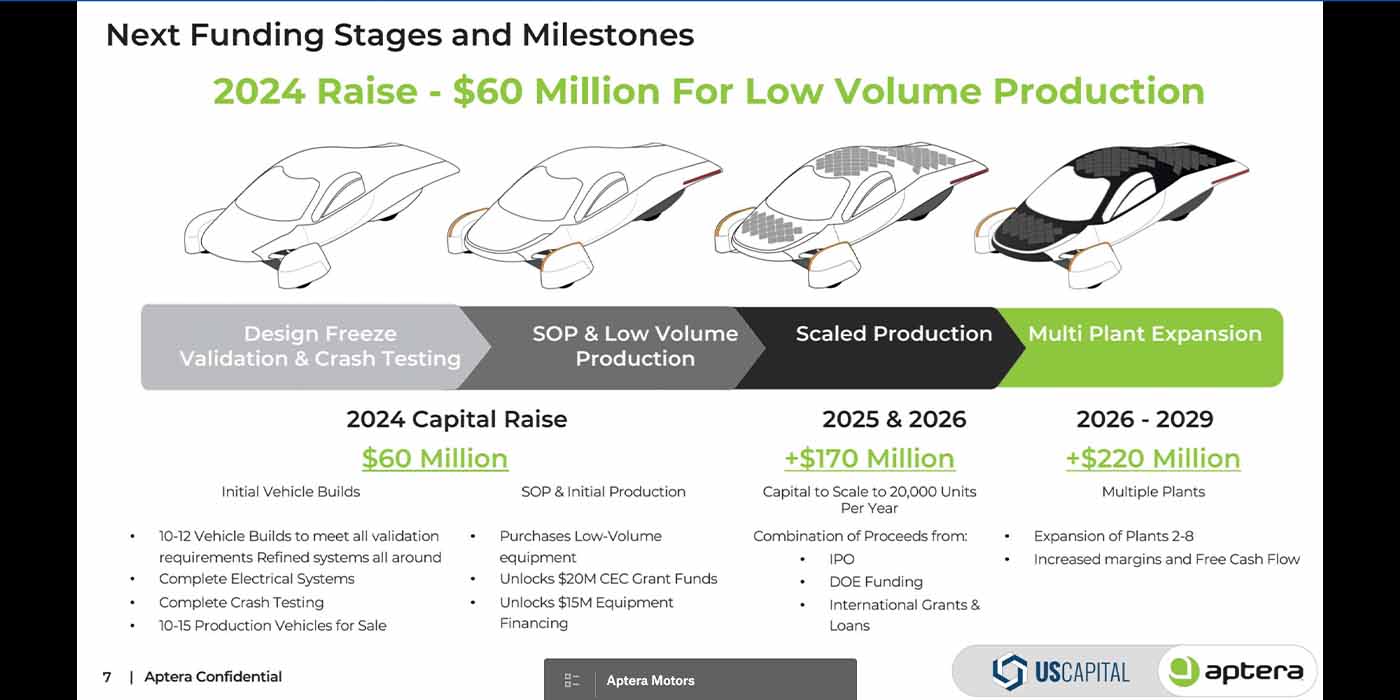

Whereas that funding has helped hold Aptera going, coming into pre-production physique in carbon (BinC) builds forward of production-intent testing, it should nonetheless want extra money to get Launch Version deliveries to these loyal buyers and past. To assist this want, Aptera Motors introduced a partnership with US Capital World this previous July, which helps increase a further $60 million in capital.

Nevertheless, three months in, that desired complete has not been achieved. Moreover, that spherical of funding is a mere stepping stone to low-volume manufacturing, and extra funding can be required to scale (see graphic beneath). With so many unknowns surrounding future funding, Aptera has amended its estimated deliveries whereas it kinds out its monetary future.

Aptera deliveries are restricted in 2025, 2026 numbers TBD

We first caught wind of the revised timelines for SEV deliveries from the Aptera House owners’ Membership Discord web page. Many customers who’re buyers within the Aptera Accelerator Program had been reporting the timelines listed on their accounts have modified from the primary half of 2025 to 2026.

I actually am a reservation holder however not an Accelerator, and my reservation modified from 2026 to “TBA.” Nevertheless, a fortunate few who invested large bucks throughout the crowdfunding marketing campaign are nonetheless secured for deliveries earlier than the top of 2025. Nevertheless, following the threads on Discord and evaluating these numbers to earlier Aptera statements and estimates in its US Capital World investor deck, the supply numbers get fairly jumbled.

Chris McCammon, Aptera’s Head of Content material, was current on the Discord web page and estimated Aptera is focusing on 60 Launch Version builds that may see deliveries to prospects in 2025. Which means solely the highest 60 Accelerators will obtain their Launch Version SEV subsequent yr. The opposite 1,940 Accelerators must wait till 2026 on the earliest.

We reached out to Aptera immediately for extra perception, and its group was capable of verify that 60 buyer builds are the goal for 2025 however that low-volume manufacturing, in addition to the scaled manufacturing to comply with, will rely closely on the $60 million US Capital increase in addition to additional funding rounds thereafter. Per a consultant for Aptera:

At this level, our major focus is securing the mandatory financing to make sure we stay on observe with our manufacturing schedule. As beforehand talked about, we’re actively pursuing $60 million in funding, which we goal to finish in a number of transactions over the following 3-6 months. This funding is crucial for advancing to low-volume manufacturing, and as soon as secured, we count on to enter manufacturing inside 9-12 months.

Chris (McCammon’s) estimate of 60 Launch Version Accelerator deliveries in 2025 aligns with our objective for the preliminary low-volume manufacturing. Nevertheless, the whole quantity for the yr relies on securing the $60 million in funding and subsequently, can be a transferring goal.

Whereas some reservation holders could also be disheartened by the information of getting to attend longer for Aptera deliveries, the newest replace to reservation pages shouldn’t actually come as a shock primarily based on what we already knew following the US Capital World announcement. Even again in July, we warned reservation holders that 2026 would doubtless be the earliest they’d see any substantial SEV deliveries, and that was when Aptera was predicting to construct 371 models in 2025. That quantity might be nearer to 100 now.

There ought to be no trigger for alarm primarily based on the revised supply timelines. Aptera is continuous to make progress by manufacturing intent builds and will nonetheless scale pretty shortly in 2026 and past. What’s worrisome is that low-volume manufacturing and people scaled SEV builds in 2026 and past will depend on a hefty inflow of funding. We requested Aptera about that progress and about its long-teased IPO. Per a consultant for the corporate:

Trying forward, we goal to ramp up manufacturing by 2026, although the dimensions of this ramp-up will largely rely on once we safe the present $60 million goal. Our final objective of manufacturing 20,000 autos yearly would require roughly $195 million in further capital, which we plan to lift by a mixture of financing methods, together with fairness, debt, and probably an IPO, as you talked about.

Aptera Motors fights on, and we’re rooting for them, however the largest beast to beat in its startup saga has all the time been and continues to be its want for substantial funding. Finishing the $60 million funding spherical that’s presently ongoing can be a significant milestone, however the approximate $195 million required after that to ship greater than 60-ish focused SEV deliveries exhibits simply how a lot of an uphill battle Aptera continues to face in scaling its expertise.

Hopefully, it may harness all that sun’s energy and attain the promised land for the sake of the surroundings and cool-ass EVs. As all the time, you may reserve an Aptera for less than $70; you simply could also be ready some time for a supply.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.