Tesla received a brand new, beneficiant worth goal projection from analyst Cathie Wooden and her agency ARK Make investments, though it disregarded a number of huge components.

In response to ARK’s newest Tesla projection report, which was launched on Wednesday, the agency expects the corporate’s worth to swell to $2,600 per share, with a bull case of doubtless $3,100 and a bear case of $2,000.

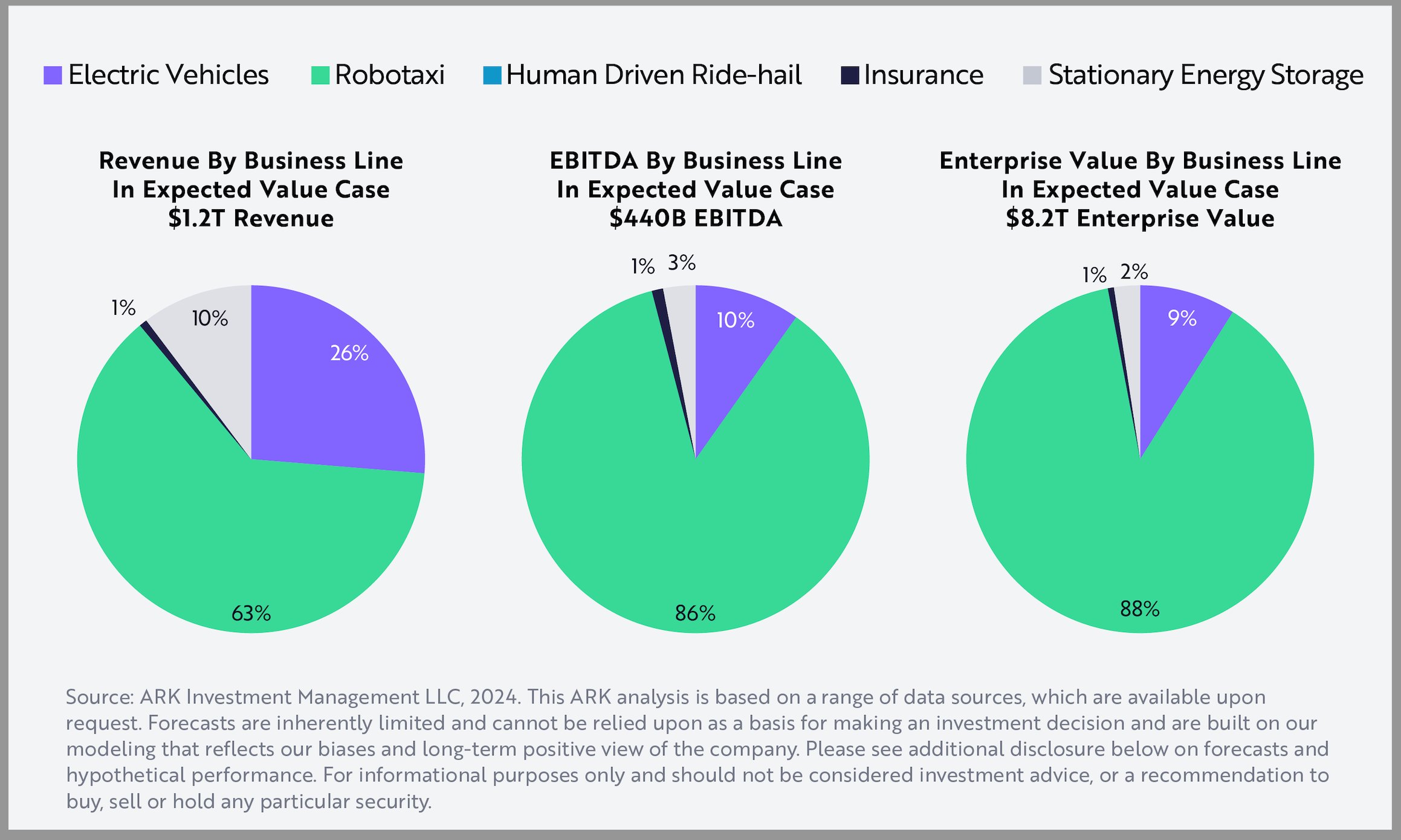

“ARK estimates that just about 90% of Tesla’s enterprise worth and earnings might be attributed to the robotaxi enterprise in 2029, as proven beneath. In the meantime, electrical automobiles may approximate 1 / 4 of complete gross sales and ~10% of Tesla’s earnings potential, as we imagine the robotaxi enterprise may have a lot increased margins. The charts beneath break down attributable income, EBITDA, and enterprise worth by enterprise line,” its evaluation breakdown stated.

You will need to notice ARK Make investments has been significantly bullish on Tesla and its enterprise mannequin for a while. Nevertheless, it was positive to notice that in its newest projections, it didn’t think about robotics, as Tesla continues to develop its Optimus Bot and not too long ago said it has been utilizing it in Gigafactory Texas.

We conservatively assumed that Tesla doesn’t promote Optimus externally in our mannequin, and that Optimus manufacturing financial savings modestly influence Tesla’s prices in single digit percentages over the following 5 years.

— Tasha Keeney (@TashaARK) June 12, 2024

ARK broadened this concept in its report:

“We assume that Optimus may have minimal influence on our worth goal. Over the following decade, we anticipate Tesla to turn into a number one producer and repair supplier of robots that transfer by way of bodily area, as it’ll have the chance to leverage learnings from robotaxis in addition to its in-house inference chips, coaching compute, and manufacturing scale. Tesla expects Optimus to be finishing helpful manufacturing facility duties by yr finish. Assuming that it have been capable of subsume 10-20% of Tesla’s labor hours labored with productiveness equal to or twice that of its human counterparts, Optimus may save Tesla $3-4 billion, or 1-2% in manufacturing prices, in 2029.”

In actual fact, the most important single think about its evaluation is that of the Robotaxi, which accounts for the overwhelming majority of the breakdowns ARK illustrated for Income, EBITDA, and Enterprise Worth:

There are a number of issues ARK disregarded of its analysts, and some of them are arguably groundbreaking and will doubtlessly have a significant influence on Tesla’s enterprise sooner or later:

- Tesla Semi – ARK doesn’t imagine the Tesla Semi will “contribute considerably” to the corporate’s worth throughout the five-year funding time horizon

- Supercharging Community – Tesla Superchargers are “unlikely to generate important income,” though they’re important for EVs

- FSD Licensing – Non-Tesla FSD automobiles are unlikely to debut throughout the five-year timeframe

- AI-As-A-Service – AI-inference-as-a-service and Dojo training-as-a-service is “in all probability” exterior the five-year timeframe

You possibly can learn ARK’s full report right here.

I’d love to listen to from you! In case you have any feedback, considerations, or questions, please e-mail me at [email protected]. It’s also possible to attain me on Twitter @KlenderJoey, or when you’ve got information suggestions, you may e-mail us at [email protected].