Should you ask Lucid (Lucid) CEO Peter Rawlinson, the corporate is the “most immune” EV maker if President-elect Donald Trump cuts the federal tax credit score for electrical automobiles. Regardless of the declare, Lucid’s inventory is hitting a brand new all-time low at beneath $2 a share.

Is Lucid proof against shedding the EV tax credit score?

Lucid is coming off its third straight file quarter of deliveries. With one other 2,781 autos offered in Q3, Lucid’s supply complete reached 7,142 by means of the primary 9 months of 2024, already topping the 6,001 deliveries in 2023.

Nevertheless, share costs are sinking following a Reuters report on Thursday that Trump’s transition crew is “planning to kill” the federal EV tax credit score, which gives as much as $7,500 for clear automotive patrons.

The report additionally cited two sources claiming that representatives from Tesla (TSLA) informed Trump’s crew that they supported the plans to finish the subsidy.

CEO Elon Musk, who totally endorsed Trump, stated shedding the credit score might barely affect Tesla’s gross sales however could be “devastating” to others within the US.

Though its luxurious Air sedan, beginning at $69,900, doesn’t qualify for the $7,500 credit score, Lucid is passing it on to some by means of leasing. Nevertheless, Rawlinson stated lots of its shoppers make greater than the $150,000 for single filers and $300,000 threshold for {couples} submitting collectively.

Due to that, even when Trump cuts the EV tax credit score, Lucid’s CEO believes it’s in a stronger place than a lot of the competitors.

When requested about Trump’s plans, Rawlinson stated on Bloomberg Tv on Friday that “Lucid, amongst all of the EV makers, is de facto probably the most immune from that.”

Lucid’s CEO additionally stated he isn’t apprehensive about Musk getting favorable therapy when Trump takes workplace. Rawlinson defined:

We’ve actually taken the mantle of expertise management from Tesla proper now, and this isn’t actually sufficiently acknowledged. So, I believe we’re in a really robust place to climate any such storm.

Lucid opened orders for its first electrical SUV earlier this month. Beginning at $79,800, the Lucid Gravity is predicted to get a powerful vary of 440 miles per cost.

Rawlinson calls the Gravity a “landmark product” with its most superior expertise but, which he claims is “years forward of the competitors.” Final month, we received our first look at its lower-priced midsize electrical SUV. Costs for the brand new mannequin will begin at beneath $50,000.

It will likely be the primary of a minimum of three midsize Lucid EVs, with manufacturing anticipated to start in late 2026. Rawlinson stated the midsize fashions are aimed “proper within the coronary heart of Tesla Mannequin 3, Mannequin Y territory.”

Regardless of the boldness, Lucid’s inventory hit its lowest value on Friday since going public in July 2021. Lucid shares are down practically 17% this week, sitting at beneath $2 per share.

Electrek’s Take

Ending the federal tax credit score will put the complete US auto trade behind. China continues to achieve extra world market share as leaders like BYD broaden into key abroad markets like Europe, Southeast Asia, and Central and South America.

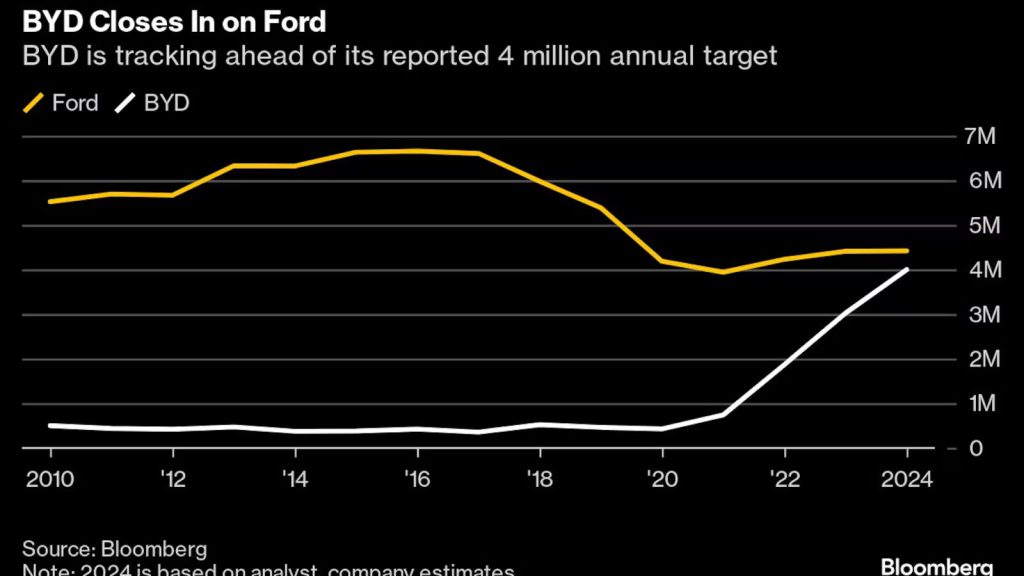

In actual fact, in keeping with Bloomberg, BYD is shortly closing in on Ford in world deliveries and will even high the American automaker by the tip of 2024.

BYD’s surging world presence is primarily as a consequence of its early beginnings as a battery maker. Nevertheless, China’s authorities can also be fueling EV gross sales development with subsidies for those who commerce in gas-powered autos.

Based on Rho Movement, China continues dominating the worldwide market with a file 1.2 million EVs offered in October alone. China has now offered 8.4 million EVs in 2024, up 38% year-over-year (YOY), in comparison with 1.4 million within the US (+9% YOY).

Rawlinson could also be proper. Lucid could possibly be probably the most immune if the tax credit had been minimize. Nevertheless, different US automakers, like Ford, GM, and Jeep-maker Stellantis, is probably not as fortunate.

So, what occurs if the subsidies are killed off? American automakers will possible delay or cancel extra EV initiatives (new fashions, battery crops, manufacturing services), which is able to ship them additional behind within the world market.

Ford’s CEO Jim Farley warned rivals earlier this yr, saying if they can’t sustain with the Chinese language, “then 20% to 30% of your income is in danger.” He added, “Because the CEO of an organization that had bother competing with the Japanese and the South Koreans, we have now to repair this downside.” Ending subsidies would solely put them additional behind.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.