Aptera’s new accomplice, monetary group US Capital International, helps lead the photo voltaic EV startup’s newest funding spherical, which can supply as much as $60 million in convertible notes. With this funding, Aptera hopes to finish manufacturing intent SEV builds for crash testing forward of a (very) low-volume begin of manufacturing in early 2025. Right here’s the newest.

No matter how this all inevitably pans out for Aptera Motors, the second iteration of the photo voltaic EV startup has already demonstrated the ability of the individuals once they imagine in your product. Most of Aptera’s progress so far has been made potential by crowdfunding and different investments from reservation holders.

The corporate has raised a powerful $135 million from over 17,000 traders, touted by the startup as probably the most profitable crowdfunded increase in historical past. Nonetheless, scaling is tough for startups within the EV house, and Aptera’s journey isn’t any completely different.

Though it is vitally a lot afloat, Aptera has all the time been refreshingly clear about its want for added capital to lastly attain a begin of photo voltaic EV manufacturing and, moreover, scale that mannequin to ship its expertise in mass portions.

Following a profitable Accelerator Program that secured its first 2,000 construct slots to traders, Aptera ended crowdfunding in favor of latest capital ventures forward of a deliberate IPO, together with the choice for self-directed IRAs.

In Could, Aptera introduced it had secured the assistance of funding agency US Capital Group to help after its Regulation A funding program ended on June 30, 2024. The group is transferring shortly with its new accomplice in securities choices and is now main a recent funding spherical to assist Aptera proceed photo voltaic EV improvement.

US Capital takes lead on $60M Aptera funding spherical

Per Aptera Motors, its new accomplice and SEC-regulated funding group US Capital have begun providing eligible events a recent alternative to take a position within the photo voltaic EV startup.

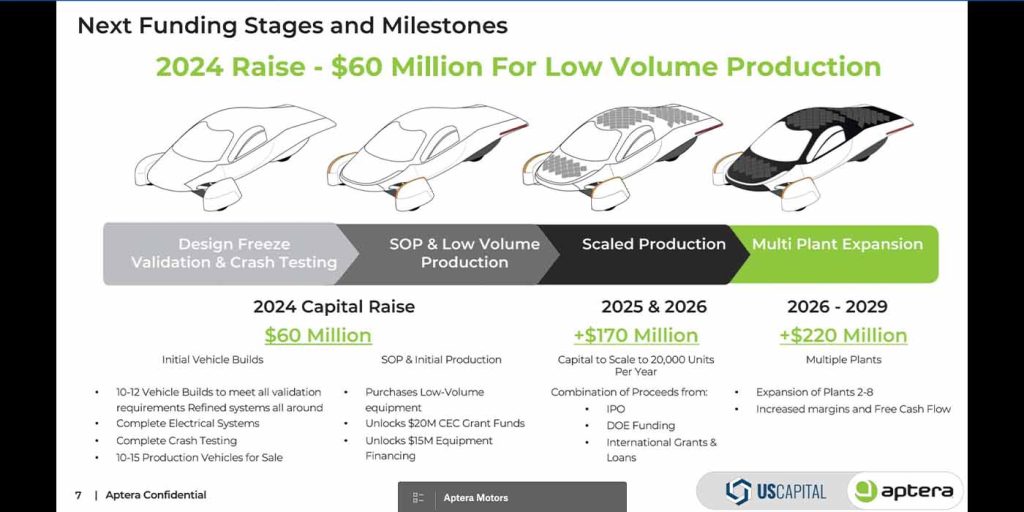

The most recent spherical contains as much as $60 million in convertible notes Aptera Motors Corp. – a determine that, in accordance with US Capital’s Aptera investor presentation, will present the startup with sufficient money to construct 10-12 validation prototypes, full crash testing, then manufacture 10-15 manufacturing intent autos that shall be bought. Per US Capital International CEO Charles Towle:

With its important patent portfolio, which incorporates over 34 patents in course of, Aptera is dedicated to remodeling the automotive business. Aptera is looking for to boost $60 million in convertible notes to provoke the manufacturing of its flagship automobile. The Firm already has substantial order traction, with over 48,000 automobile pre-orders representing greater than $1.7 billion in income. For traders in search of alternatives, Aptera provides a compelling proposition in our view. Eligible traders at the moment are invited to take part on this distinctive $60 million convertible word providing.

If profitable, the 2024 capital increase also needs to be sufficient cash to allow Aptera to buy all the mandatory gear for low-volume photo voltaic EV manufacturing, which might, in flip, unlock entry to beforehand awarded grants and financing totaling one other $35 million.

Aptera’s focused funding phases (seen above) are fairly doable in comparison with bigger EV OEMs. Nonetheless, US Capital’s funding deck nonetheless paints an image of how tough will probably be for the startup to scale, particularly on the automobile MSRPs initially promised.

Should you’re in line for an Aptera photo voltaic EV, you clearly have persistence, however you will want to metal your self additional as you in all probability received’t see a supply till 2026 on the earliest. Per the funding deck, Aptera solely plans to promote 371 autos when low-volume manufacturing begins in early 2025.

That quantity jumps to 11,000 models in 2026 earlier than Aptera scales to twenty,000 every year thereafter.

With $1.7 billion in potential order income, the demand is there, and investments from these early believers have gotten Aptera Motors this far. Nonetheless, the following section would require extra assured capital extra shortly, and that demand for funds will solely develop because the startup appears to scale and hopefully make some influence on the EV business.

As all the time, we’ll regulate Aptera and its newest name for investments to maintain you abreast of its progress (or failure). Should you’re prepared to attend a number of years, you may nonetheless reserve an Aptera photo voltaic EV for under $70 down.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.