Chinese language EV makers, together with BYD, accounted for over 40% of German EV imports via April 2024. China remained the biggest EV importer in Germany forward of the brand new EU tariffs. Can China preserve the momentum with further tariffs on EV imports of as much as 38.1%?

Regardless of Chinese language electrical automobile imports slipping 15.7% in Germany via the primary 4 months of 2024, their market share nonetheless elevated.

In keeping with knowledge launched by the German statistics workplace Tuesday (through Reuters), German EV imports from Chinese language automakers like BYD reached 31,500 via April 2024. China held the area’s largest share of EV imports at 40.9%.

The statistics workplace defined that the decrease imports had been as a consequence of weaker home demand. Whereas Chinese language EV imports fell barely, different international locations, like South Korea, noticed an almost 50% drop in EV imports.

“Chinese language electrical automotive imports thus declined rather more weakly than whole imports of electrical automobiles,” the German statistics workplace said.

The market share development comes because the EU revealed further tariffs that will likely be positioned on Chinese language EV imports final week.

Will the brand new EU tariffs impression BYD, China EV imports?

If no decision is discovered by July 4, 2024, BYD will obtain a further 17.4% tariff, Geely will get an additional 20%, and SAIC will obtain a 38.1% further obligation. Different Chinese language EV makers, like NIO, will get an additional 21% tariff on European EV imports.

Nevertheless, the additional prices might not be sufficient to discourage Chinese language automakers from promoting EVs abroad.

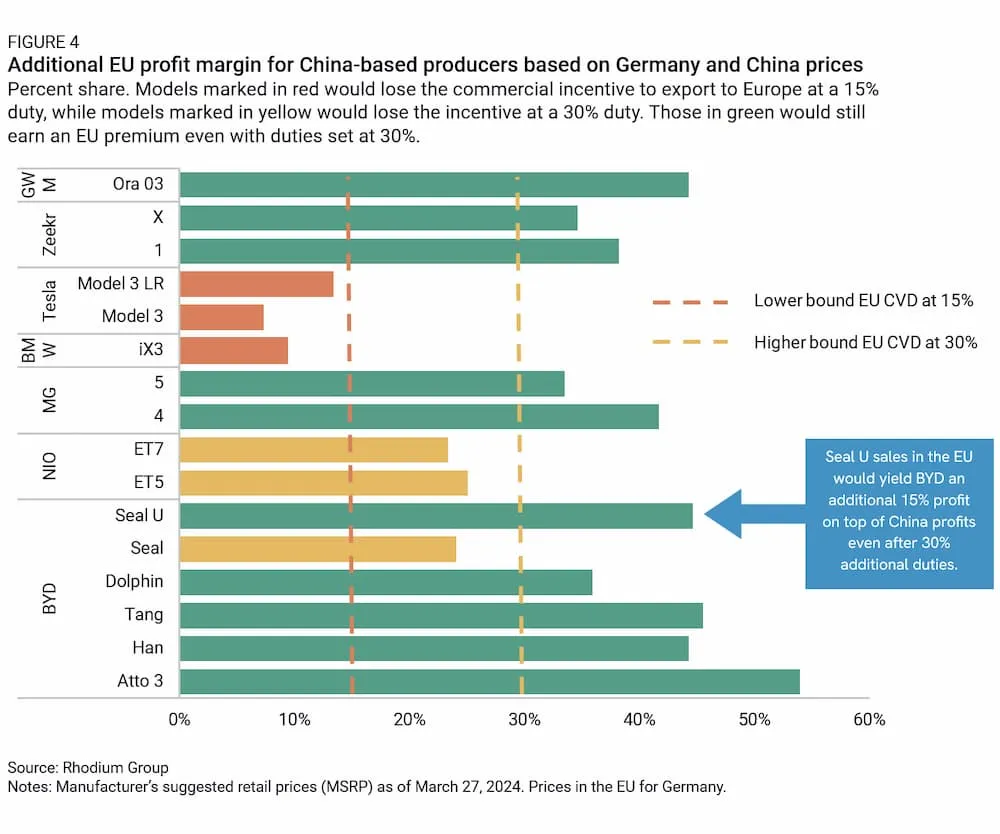

Analysis from Rhodium Group reveals even with an additional 30% tariff, BYD would nonetheless earn a +15% revenue on its Seal U bought within the EU over China.

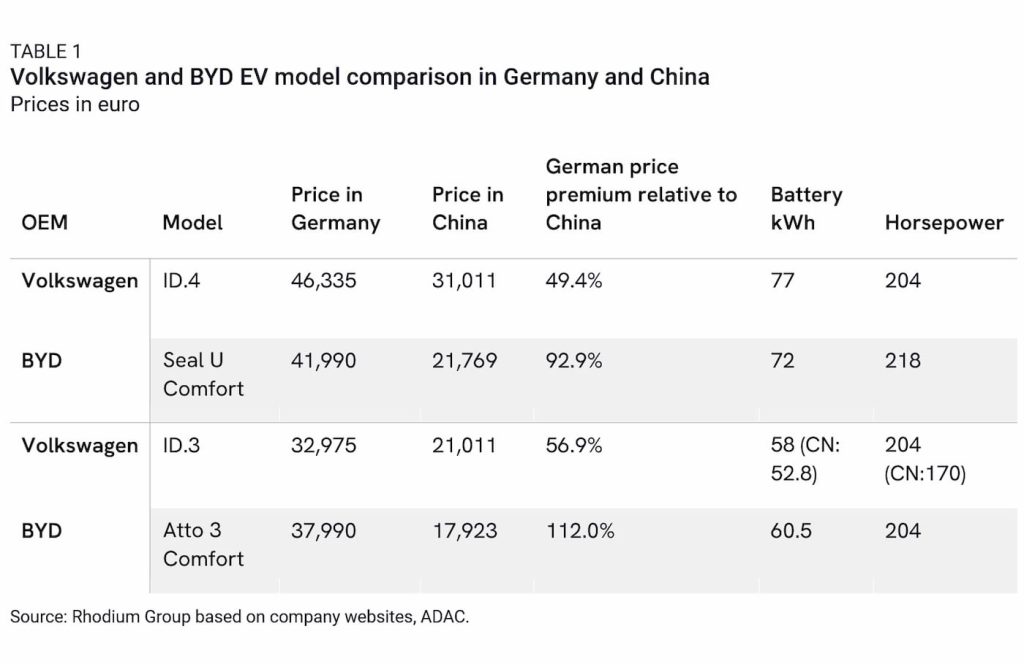

BYD’s Seal U prices practically 93% extra (41,990 euro vs 21,769 euro) in Europe than in China. In comparison with different automakers like Volkswagen, with a 50% markup on the ID.4, BYD is having fun with extra of the “EU Premium” on EVs.

In keeping with the examine, tariffs could must be raised to 40%, 50%, or greater to sluggish the momentum.

Electrek’s Take

A number of Chinese language automakers, like BYD and NIO, are nonetheless dedicated to increasing their manufacturers in Europe regardless of potential tariffs.

Current analysis suggests automakers like BMW will see a number of the most extreme impacts. Even with the additional duties, BYD’s most cost-effective electrical automotive, the Seagull, is anticipated to reach with costs beginning beneath $21,500 (20,000 euros).

In China, BYD’s Seagull EV begins at $9,700 (69,800 yuan). In abroad markets, like Brazil, the low-cost EV begins at round $20,000 (99,800 BRL).

BYD’s CEO, Wang Chuanfu, stated the EU and US had been “afraid” of Chinese language EVs earlier this month. “If you’re not sturdy sufficient, they won’t be afraid of you,” Wang defined. BYD’s chief stated the brand new tariffs are a testomony to China’s auto trade power.

What do you guys assume? Can BYD and different Chinese language EV makers preserve their momentum with new tariffs? Tell us your ideas within the feedback.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.