- By all accounts, electrical college buses provide an excellent use case for vehicle-to-grid (V2G) expertise. Synop offers software program that permits V2G for fleets, permitting native utilities to speak with fleet operators and provoke V2G transactions.

- V2G pilots abound, however Synop is likely one of the few corporations that may declare to be doing V2G on a least a quasi-commercial foundation—in 2023, the corporate enabled some 200 V2G transactions throughout 4 US states, sending some 30 MWh of vitality again to the grid.

- Synop CEO Gagan Dhillon believes that, for the time being, V2G is sensible just for a number of use instances (college buses, drayage), and that the expertise might want to mature earlier than we see widespread deployment. Not all utilities are able to feeding vitality again to the grid, and the income and monetary features of V2G are nonetheless largely undefined.

Q&A with Synop co-founder Gagan Dhillon

Automobile-to-grid (V2G) expertise is a scorching matter—many EV trade execs say it has the potential to rework the transport and vitality industries (we hear the time period “game-changing” lots). Nonetheless, others have informed Charged that they anticipate it to be extra of a distinct segment expertise, helpful solely in sure functions. One factor everybody appears to agree on is that one of the promising use instances for V2G is an electrical college bus fleet.

The proliferation of electrical college buses at college districts throughout the US is being pushed by a number of components. The enduring yellow buses journey common routes that are usually brief, and so they return to central depots the place they’ve loads of time to cost. College districts admire the financial savings on gasoline and upkeep, and the concept of sparing schoolchildren from respiratory diesel fumes tends to attraction to folks and different stakeholders, even those that would possibly in any other case be unenthusiastic about EVs.

College buses’ typical obligation cycles make them an excellent use case for V2G. They’ve giant battery packs, they congregate in giant numbers at depots and, at a typical college district, they sit parked in the course of the night hours and over the summer season months—usually instances of peak vitality demand when utilities are almost certainly to want storage to alleviate the grid.

All these components mix to provide electrical college buses a shorter payback interval than simply about some other EV utility—however V2G presents the potential not simply to avoid wasting prices, however to generate income—and that’s one thing our chronically underfunded faculties can at all times use.

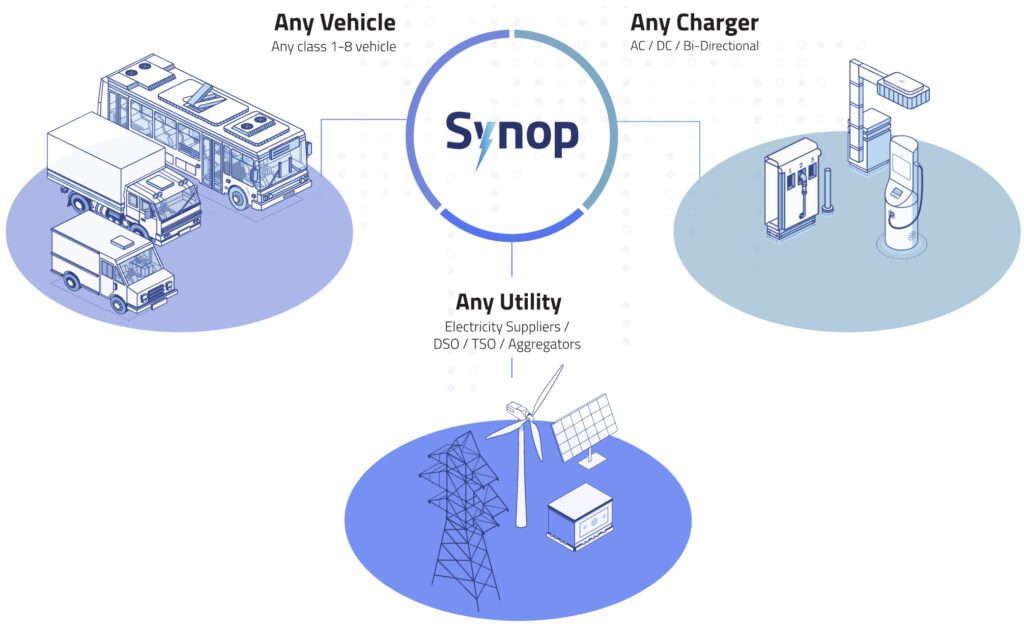

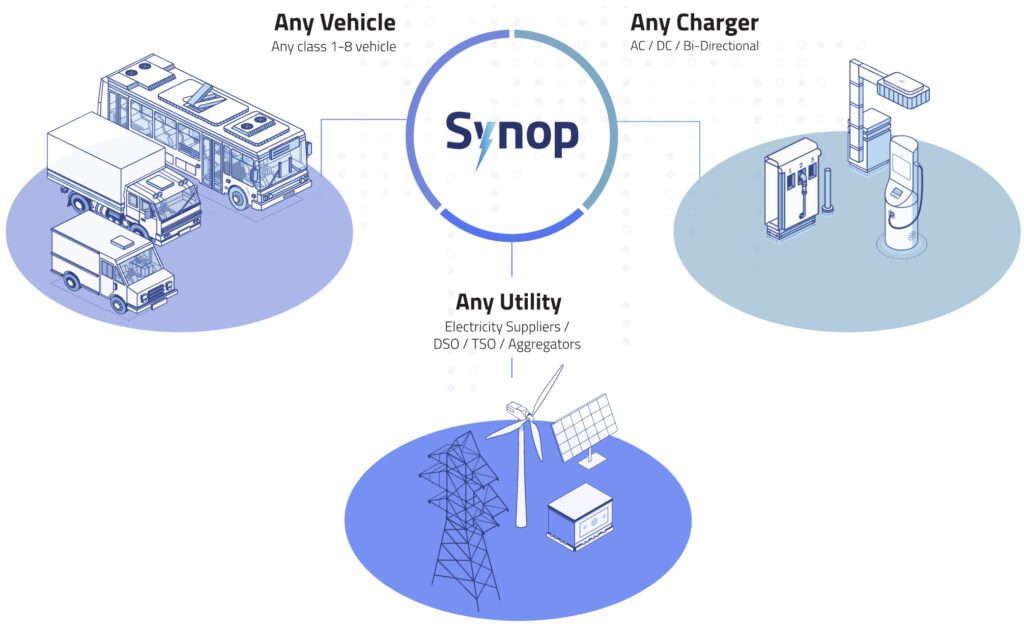

After all, making V2G work requires software program, and that’s the place Synop is available in. The Brooklyn-based startup offers a platform designed to optimize vitality administration for EV fleet charging. Synop’s business charging and vitality administration software program integrates with autos, chargers and utilities, enabling V2G transactions.

Right here’s the way it works: Synop’s system receives prompts from the native utility requesting a certain quantity of storage for a selected time interval. The software program then verifies the fleet charging schedule to substantiate extra capability. Upon validation, the platform delivers the suitable charging schedule to the chargers utilizing the Open Cost Level Protocol (OCPP), and the surplus vitality is discharged from the automobile battery packs again to the grid.

This isn’t simply hypothetical. In the course of the summers of 2021 and 2022, Synop participated in a business V2G pilot for Massachusetts electrical utility Nationwide Grid. College bus operator Highland Electrical Fleets led the venture, BorgWarner supplied the DC quick charging system, Thomas Constructed Buses supplied the automobile, and the late Proterra supplied the battery expertise. Over 158 hours throughout each summers, a single bus discharged 10.78 MWh to the Massachusetts grid, producing $23,500 in income.

Charged lately spoke with Synop co-founder and CEO Gagan Dhillon.

Charged: What impressed you to start out an organization to develop fleet charging administration software program?

Gagan Dhillon: I used to be uncovered to the world of business trucking by some initiatives I used to be doing with Volvo Vans, and virtually all their fleet clients had been fascinated about electrification. This was 2020, and co-founder Andrew Blejde and I didn’t suppose anyone was constructing charging, vitality and automobile administration instruments in an operational software program system, so {that a} fleet operator may have all of that in a single place. We landed our first buyer in late 2021. That was Highland Electrical—they’re a faculty bus operator, and so they’re providing a turnkey answer for electrical college buses.

We began offering charging administration and vitality administration software program for depot operators. These operators have since began to develop instruments for office charging, to open up these chargers for alternative charging, so now we’re beginning to handle that for them as nicely.

Charged: Are you primarily centered on college buses?

Gagan Dhillon: No, truly, we have now Class 8 electrical vehicles, we have now last-mile supply vans. The varsity bus stuff will get probably the most press for us, however I might say there are as many Class 8 vehicles and supply vans on our platform as there are college buses.

Charged: All people appears to agree that college buses are an excellent use case for vehicle-to-grid, however that for the time being V2G is just about within the pilot stage. However your pilot with Highland generated some critical money, and also you’ve since developed different initiatives—may we describe these as business?

Gagan Dhillon: I feel vehicle-to-grid remains to be very a lot a nascent expertise, and I do suppose that vehicle-to-grid can also be a use case particular to the varsity bus world [at the moment]. We did about 200 vehicle-to-grid transactions in 2023, throughout most likely 20 or 30 autos. We despatched again 30 megawatt-hours of vitality, which is the equal of powering 1,000 common US houses for a day. And we’ve finished that throughout 4 completely different states.

I don’t suppose we’re able to say that these are totally baked business alternatives, simply because there’s a lot that goes into executing one. The commercialization of them remains to be being outlined, the income a automobile operator generates remains to be being outlined—it’s very case-by-case. It’s going to take a little bit of time for everybody to get on the identical web page about what V2G can do from a income and monetary standpoint. However from a use case standpoint, we demonstrated that this expertise works, and that we are able to nonetheless keep the uptime of a automobile even when we drain its battery.

Charged: You’ve got initiatives with a number of utilities throughout 4 completely different states.What are among the variations amongst these initiatives?

Gagan Dhillon: The toughest half is at all times the connection between the charger and the automobile. The factor that doesn’t actually matter as a lot is the locale, so long as the utility has the flexibility to tug vitality off of a web site. Sometimes, a utility won’t ever undergo setting us up if they’ll’t try this, in order that’s an enormous barrier that will get solved earlier than we ever present up. However having the ability to optimize the connection between a automobile and a charger, after which having the ability to dispense vitality after which repower the automobile inside a well timed interval for its obligation cycle—that orchestration is the exhausting half.

Charged: So, the flexibility to feed electrical energy again to the grid isn’t one thing {that a} utility can simply robotically do?

Gagan Dhillon: They should have the flexibility to simply accept energy on their finish, after which they want to have the ability to have a view into the facility accessible. That’s one of many issues that we give utilities—they’ll come onto our platform and say, “I’ve received 10 kilowatt-hours of vitality accessible at this web site based mostly on the vitality that these autos presently have. I’m going to tug that energy between 3:00 and 4:00 pm.” So these insights, that operational readiness, is what they’re counting on us for.

We’re working with a lot of firms, together with Highland Fleets, Lion Electrical, and Prologis. We’re Prologis’s backend for all of the fleet electrification work that they’re doing. These are among the ones I can identify publicly.

Charged: Let’s say we need to arrange a faculty bus V2G program. What are the items of the puzzle? What completely different sorts of firms must work collectively?

Gagan Dhillon: That’s the straightforward half: it’s the varsity bus fleet operator and the utility. They have to be those that decide in. Then they want a software program supplier to allow that opt-in and allow the execution of the transaction, and that’s the place we are available in.

“It’s going to take a little bit of time for everybody to get on the identical web page about what V2G can do from a income and monetary standpoint. However from a use case standpoint, we demonstrated that this expertise works.”

Charged: Some firms present charging administration software program as a part of a turnkey fleet administration system. May a few of these turnkey infrastructure suppliers even be your clients?

Gagan Dhillon: We’re simply software program—we imagine that the software program goes to be the important thing piece on this trade. A variety of the opposite stuff goes to change into increasingly more commoditized, so we need to construct best-in-class software program for fleet operators.

Many of the turnkey infrastructure suppliers are clients of ours. We’ve received 5 of these clients. I’m not at liberty to say which of them, as a result of we offer a customized white-label answer to them, so in the event that they introduce a software program software, it’s going to feel and look like their software, and that’s the worth proposition that we’re giving them.

Charged: What do you concentrate on Proterra? I actually thought that was a robust firm, and I used to be fairly shocked after they crashed.

Gagan Dhillon: Yeah, I used to be most likely equally shocked—we had good relationships with Proterra. We work with plenty of joint clients and plenty of their college buses are on our platform. I do know that they’ve gone by an public sale course of and completely different elements of the enterprise have been bought off, however I feel that powertrain enterprise wants to remain as a part of our trade due to what number of companies depend on it.

They’d a software program that they developed referred to as Valence. A few of their clients used Valence and a few didn’t. We had the flexibility to onboard their {hardware} onto our system, so we had a partnership that allowed that in sure instances.

Charged: I’m seeing the event of a versatile ecosystem the place an organization would possibly present one piece of the puzzle, or a number of items, or they may provide a complete turnkey bundle. It will get complicated—we’ve received TaaS, CaaS, EaaS. How does all that stuff match collectively, and the way does someone type by that alphabet soup?

Gagan Dhillon: I feel the extra acronyms, the more durable it will get for folks, and I feel this trade nonetheless has plenty of maturation that it has to undergo. There are plenty of {hardware} gamers on this area, and I feel there’s going to be consolidation there.I additionally imagine that there’s going to be a brand new set of requirements that have to be developed for fleet operators, and these acronyms have to change into much more outlined.

My candid perception is that persons are generally being bought options which can be too complicated for his or her wants. That is the pure cycle of an early-days trade—persons are studying and operators are studying. I feel in a couple of yr or 18 months, options will begin to change into productized so you realize what you’re shopping for each single time, and it’s the identical software set to unravel the identical use case. I feel our trade actually wants that if it’s going to take the following step to impress all of the property folks need to electrify.

Charged: What are another compelling use instances for EVs for the time being?

Gagan Dhillon: Drayage, taking items from ports, particularly in California and different seaports, after which driving them to the preliminary warehouse. We now have no less than 10 clients in that area presently. After which after all there’s the last-mile supply use case. Not at liberty to talk on this one but, however we’ve received some substantial companions in last-mile bundle supply.

Charged: Might these even be use instances for V2G?

Gagan Dhillon: Hypothetically, V2G could possibly be utilized to drayage and last-mile supply, although predicting their obligation cycles and dwell instances—and matching these to the grid’s vitality wants—is tougher than with predictable electrical college bus routes. A drayage truck has a considerable battery, and will energy roughly 400 houses for an hour, probably having a transformative influence on the grid.

Charged: From the software program standpoint, would you say completely different use instances are fairly comparable, or is there plenty of customization you could do?

Gagan Dhillon: No, there’s not any customization, and it’s purposely constructed that approach as a result of it permits us to shortly scale with clients. Our large worth proposition is you could carry any kind of auto that’s related to telematics and any kind of charger that has an OCPP connection. We’ll undergo the interoperability testing, onboard that asset, and just remember to can deploy it as shortly as potential. Sometimes, it takes a buyer lower than a day to rise up and working on our platform.

Charged: Zooming out to the general business EV trade, among the gamers are combating exhausting towards electrification. A few of the trucking commerce associations are supporting payments to attempt to roll it again, they’re suing everyone in sight. Do you suppose they’re going to reach slowing issues down?

Gagan Dhillon: Man, I hope not, however by no means underestimate the facility of individuals in drive. I feel what actually has to occur is the price of EVs has to change into extra practical, so the use case makes much more sense for the operator and themselves. Proper now it’s simply unrealistic to anticipate anyone to pay practically $400,000 for an electrical truck. Even with the incentives, that’s a tough price for someone to abdomen, and you then put in different {hardware} prices, so I feel we’re going to proceed to cope with headwinds for shopper adoption.

Charged: Properly, that’s a great argument for specializing in issues like college buses and drayage, proper?

Gagan Dhillon: Yeah. And that’s why we predict that these are the use instances that matter in the meanwhile.