US diesel demand plummeted to its lowest seasonal stage in 26 years final quarter – however is that on account of a down economic system, or booming business EV gross sales?

The manufacturing of distillate, the petroleum-based gasoline that powers trucking, heating, and heavy business, plunged to three.67 million barrels per day in March (down from extra 4.1 million barrels final 12 months) in accordance with month-to-month information from the US Vitality Data Administration. That determine marks a downward revision from the company’s earlier estimates, and is even decrease than the identical month in 2020 (3.96 million). However, whereas much less oil is usually good for folks and planet, it’s not at all times good for earnings.

“The deteriorating diesel market is a warning sign that broader oil demand progress may very well be in danger,” in accordance with a quote attributed to Dennis Kissler, senior vice chairman for buying and selling at BOK Monetary Securities, by Transport Subjects. “Consumption of the gasoline tends to fall because the economic system slows, and a slowing economic system presages waning demand for different fuels.”

“It’s a operate of the slowing of the economies in Asia and the US and the way inflation is tightening client spending habits,” Kissler stated, persevering with to spin a decline in oil consumption as a nasty factor. “They’re not going out and spending cash like they have been a 12 months in the past.”

Is it actually inflation, or is it EVs?

Even in diesel-loving Europe, the diesel engine is dying a fast dying. Volvo, for instance, just lately constructed its last-ever diesel automobile, an XC90 (above), and rolled it straight off the meeting line and right into a museum.

Volvo’s not alone. Corporations like Nissan, Hyundai, and Daimler (mother or father firm of Mercedes-Benz and the Freightliner and Rizon truck manufacturers) have additionally backed away from creating new inner combustion engines.

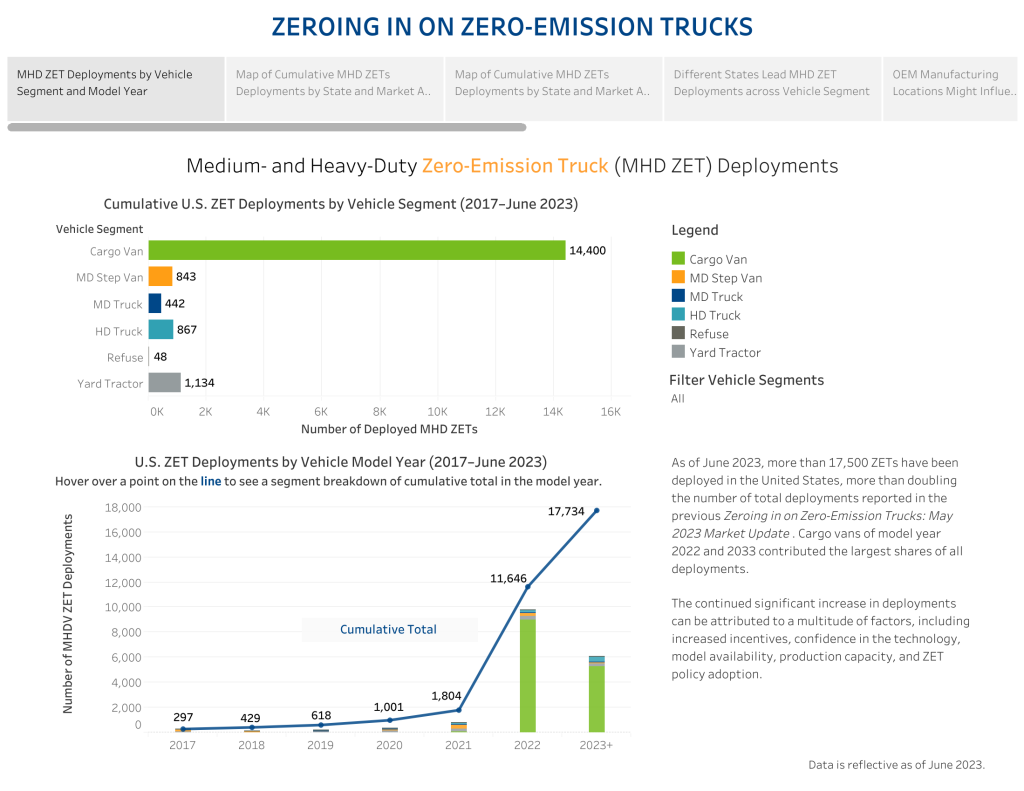

And, whereas we’re on the subject of Daimler’s truck manufacturers, it’s value noting that business EV gross sales are hovering. Regardless of all of the doom, gloom, and wishful pondering from the pro-oil/anti-EV crowd, the numbers paint a story of swift growth within the business EV and ZEV (Zero-Emission Automobile) markets, with CALSTART’s newest figures revealing a outstanding 250% progress within the zero-emission heavy truck market.

Those self same CALSTART figures, from January of this 12 months, present that the US had seen the deployment of greater than 14,000 battery-electric cargo vans in 2023, with a big surge of 11,835 items deployed within the first half of that 12 months, alone. That may be a staggering 461% enhance in deployments in comparison with CALSTART’s earlier report – and the electrification of enormous business fleets is a pattern that doesn’t appear to be slowing down.

Take a superb take a look at the numbers for HD vehicles. The CALSTART graph reveals “simply” 867 items on the highway, certain – however contemplate some latest information tales which are blowing that quantity out of the water:

I might hold going, however you get the thought: there are a whole lot, if not 1000’s of electrical vehicles on the highway at this time that weren’t this time final 12 months – and for those who don’t suppose that’s placing a damper on diesel demand I’ve a bridge to promote you.

Electrek’s Take

The oil business is aware of that we’re previous “peak oil,” and demand for diesel goes to proceed to drop. Each as a result of vehicles are electrifying and switching to hydrogen, and since diesel/ICE fashions have gotten ever extra environment friendly, utilizing much less diesel to maneuver the identical quantity of Earth and items. That’s why they’re not pulling the standard demand levers of reducing costs – as an alternative, oil firms appear to be elevating costs in comparison with crude oil and refining prices, giving this author the sense that they’re attempting to seize as a lot money as they will whereas the grabbing’s nonetheless good.

That’s my take, anyway. What’s yours? Scroll on all the way down to the feedback part on the finish of this story and tell us.

SOURCES: Tools World, Transport Subjects; different supply hyperlinks all through.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.