Ford (F) launched its second-quarter earnings on Wednesday. Though Ford beat top-line expectations with income up 6%, it missed Q2 2024 earnings expectations by a large margin.

Ford Q2 2024 earnings preview

After EV gross sales surged 61% year-over-year in Q2 2024, Ford remained the second best-selling EV maker within the US behind Tesla.

With almost 23,957 EVs offered within the second quarter, Ford topped rival GM, which offered 21,930 electrical fashions. All Ford EV fashions had double-digit YOY development.

F-150 Lightning gross sales rose 77%, with 7,902 offered. Ford offered 12,645 Mustang Mach-E’s, up 46.5%. In the meantime, gross sales of Ford’s electrical van, the E-Transit, surged 95.5%, with 3,410 fashions offered in Q2.

Regardless of the progress, Ford has pulled again on a number of EV initiatives. The American automaker has lower F-150 Lightning manufacturing, delayed round $12 billion in EV spending, and most just lately introduced plans to construct extra Tremendous Obligation vans at its EV plant in Ontario.

Ford has mentioned the changes are because of “slower-than-expected” demand. In the meantime, like rival GM, Ford will lean extra towards hybrids. Ford’s hybrid gross sales additionally picked up in Q2, rising 55.6%.

After Ford’s new F-150 was delayed, F-series pickup gross sales fell 6%. Ford’s Ranger, Maverick, and Expedition led a restoration in truck gross sales (+4.5%).

Though Ford is projected to submit Q2 2024 earnings development, it’s not anticipated to be as sturdy as rival GM. In accordance with Earnings Whispers, Ford is anticipated to submit Q2 EPS of $0.64 with income of $41.65 billion.

Monetary outcomes

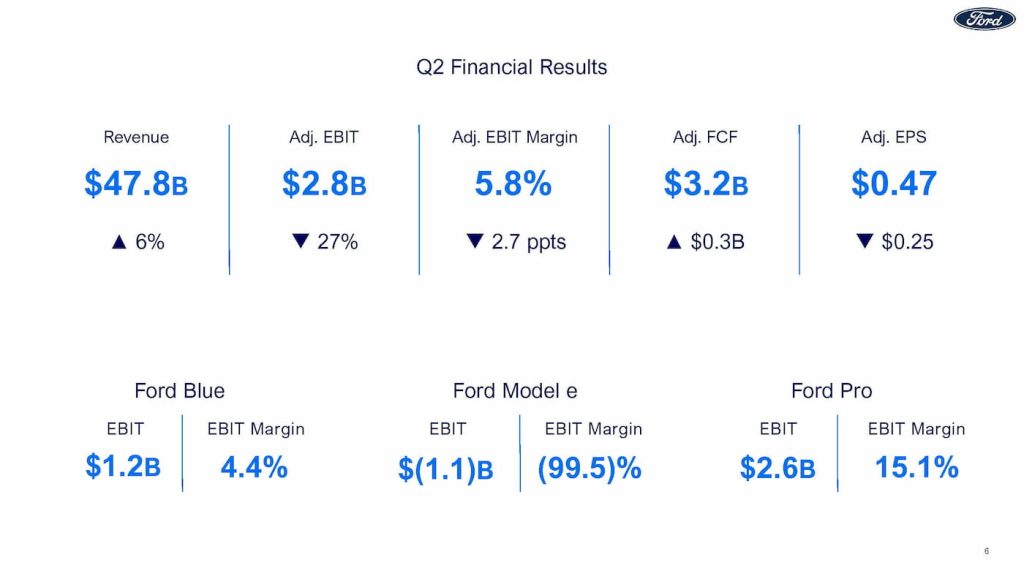

Ford posted Q2 2024 auto income of $44.8 billion, up 6% and beating projections. General income, together with Ford’s finance unit, reached $47.81 billion. In the meantime, web earnings was $1.8 billion, or $0.47 per share.

- Income: $44.8 billion vs $41.65 billion anticipated

- EPS: $0.47 vs $0.64 anticipated

With EBIT slipping 27% YOY to $2.67 billion, or 0.47 cents per share, Ford missed expectations by a large margin.

Ford Professional, its industrial and software program unit, remained the primary development driver, with income climbing 9% to $17 billion. The unit posted a powerful EBIT margin at 15.1% with Q2 EBIT of $2.6 billion.

In accordance with Ford, its Professional enterprise is worthwhile in each area it operates. Ford Professional software program subscriptions had been up 35% within the quarter, whereas cell restore orders greater than doubled.

Ford’s CEO Jim Farley mentioned it’s widespread for industrial clients to undertake new tech, together with related and EVs, earlier than people.

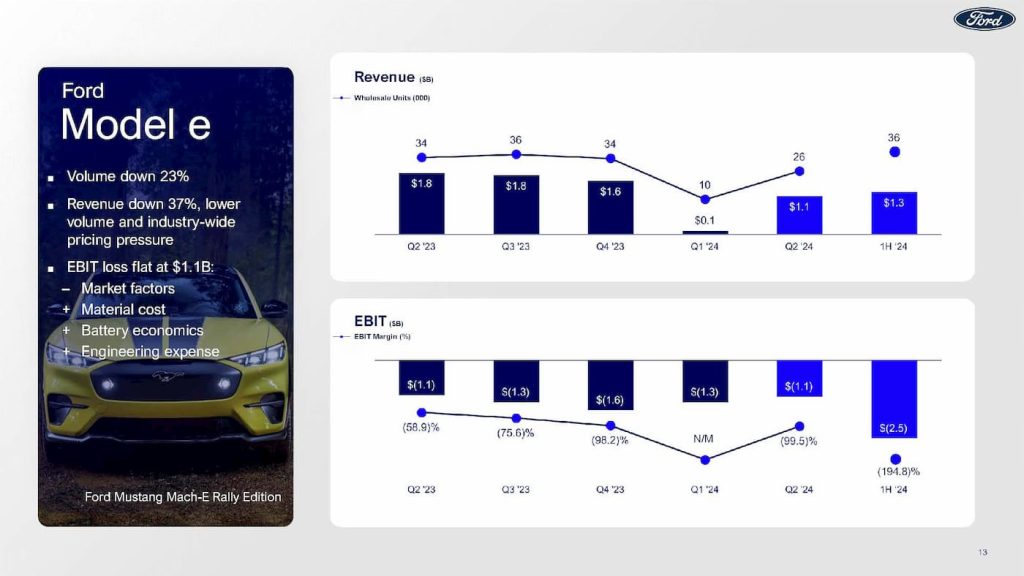

Talking of EVs, Ford’s mannequin e unit misplaced one other $1.1 billion within the second quarter. Ford Mannequin e income fell to $1.3 billion, whereas quantity was down 23% in Q2.

Ford’s EV losses are actually over $2.5 billion by the primary half of 2024. The upper losses are because of decrease quantity and “industry-wide pricing strain.”

Ford Blue, the corporate’s ICE enterprise, noticed quantity and income rise 3% and seven%, respectively.

Full-year EBIT steerage stays unchanged at $10 to $12 billion. In the meantime, Ford raised adjusted FCF expectations by $1 billion ($7.5 to $8.5 billion).

Ford nonetheless expects its Mannequin e EV enterprise to lose between $5.0 to $5.5 billion this yr. The corporate mentioned continued pricing strain and investments in next-gen EVs will contribute to the losses.

Test again for more information from Ford’s Q2 2024 earnings name at 5 PM.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.