Rivian’s (RIVN) inventory is down after a “pivotal” Q2 earnings. Though it wasn’t sufficient to persuade traders, Rivian’s CEO is defending the EV maker’s progress over the previous few months because it preps for its subsequent development stage. Right here’s what Rivian’s CEO, RJ Scaringe, needed to say.

Rivian’s inventory tumbles following Q2 2024 earnings

After shutting down its Regular, IL plant for upgrades in April, Rivian’s manufacturing slipped within the second quarter whereas deliveries remained flat.

Though this was anticipated, traders will not be satisfied of (or haven’t totally digested) the modifications.

Rivian launched its Q2 2024 earnings report Tuesday with $1.15 billion in income, assembly Wall St forecasts. Regardless of this, Rivian’s losses widened barely to $1.46 billion, or $1.46 per share, in comparison with a $1.2 billion ($1.27 loss per share) in Q2 2023.

After making “Important progress driving higher price effectivity, bettering its merchandise, and additional strengthening its stability sheet” in Q2, Rivian nonetheless misplaced $32,705 on each EV construct.

| Q3 ’22 | This autumn ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | This autumn ’23 | Q1 ’24 | Q2 ’24 | |

| Rivian loss per car | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 |

Though that’s an enchancment from Q1’s $38,784 loss, it’s nonetheless up barely from the $32,594 loss in Q2 2023.

Rivian’s traders had been apparently not impressed with inventory costs tumbling over 5% on Wednesday. Rivian’s shares are down 42% over the previous 12 months.

Mild on the finish of the tunnel

Regardless of the broader loss, Rivian reaffirmed all steering, together with attaining its first gross revenue by the top of the 12 months.

“We have to aggressively drive in the direction of profitability,” Scaringe mentioned on the corporate’s Q2 earnings name. Rivian expects a modest gross revenue within the fourth quarter of 2024.

The most important purpose behind Rivian’s confidence is the drastic modifications going down in Regular. Scaringe defined that the corporate’s plant upgrades are a “pivotal” second. Rivian reduce out 100 steps from battery making, 50 physique store elements, and 500 components from design.

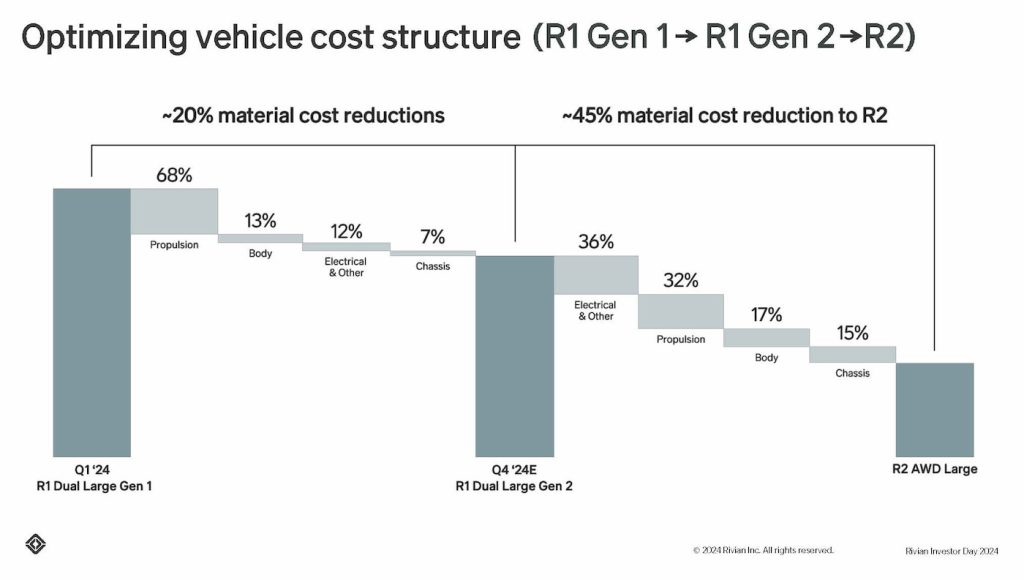

After introducing new tech, extra effectivity, and bettering provider contracts, Scaringe believes they are going to allow “important materials price reductions.”

Rivian launched its second-gen R1S and R1T earlier this summer time. The second-gen fashions have been re-engineered to chop prices. For instance, 65 components and almost 1,500 joints have been eradicated. Following the upgrades, Rivian expects a 30% enchancment within the R1 manufacturing line fee.

With new in-house motor configurations, Rivian is seeing dramatic price enhancements. Its new Ascent Tri motor prices 32% lower than its Origin Quad, whereas the Ascend Quad prices 24% much less.

The following era

The brand new know-how will function the inspiration for Rivian’s next-gen R2. Rivian expects to start R2 manufacturing in Regular in early 2026.

Beginning at $45,000, the R2 is sort of half the price of Rivians R1S and R1T. Rivian’s flagship R1 fashions helped set up it as a real premium EV maker, however R2 will open it as much as the mass market.

Scaringe mentioned the R2 is “Worlds totally different” from Tesla’s Mannequin Y because it seems to be to seize a share of the surging mid-size SUV market.

Rivian’s R2 already has “nicely over 100,000” pre-orders and climbing, in keeping with Rivian’s Vice President of Manufacturing Tim Fallon.

As soon as R2 manufacturing begins, it should account for almost all of Rivian’s output. Rivian plans to construct 155,000 R2 fashions yearly and about 85,000 R1S and R1Ts in Regular.

Talking with Bloomberg following Rivian’s Q2 earnings, Scaringe defended the corporate’s progress regardless of the inventory slipping.

Scaringe defined the enhancements and new tech Rivian launched will assist drive down prices. The last word aim is to achieve profitability. Nevertheless, Scaringe mentioned, “the largest singular step” Rivian has made thus far was in Q2.

Rivian’s CEO believes the upgrades will “take us to a spot the place the incremental contribution of each car we promote is constructive.” And that’s what Rivian expects to achieve within the fourth quarter.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.