Rivian (RIVN) shares hit a brand new yearly low on Monday, dropping practically 10%. Regardless of reaching its first gross revenue in This fall, Rivian’s inventory is taking a beating resulting from blended analyst opinions. Right here’s what they’re saying.

Final week, Rivian launched its fourth quarter 2024 earnings, saying a gross revenue of $170 million. Though nonetheless a comparatively small quantity, it’s an enormous $776 million enchancment from This fall 2023 and Rivian’s first constructive gross revenue.

After shutting down its manufacturing plant in Regular, IL, final April for upgrades and launching its second-generation R1 autos, CEO RJ Scaringe stated the corporate is seeing “significant” value reductions.

“This quarter, we achieved constructive gross revenue and eliminated $31,000 in automotive value of products offered per car delivered in This fall 2024 relative to This fall 2023,” Scaringe defined final week after releasing fourth-quarter earnings.

Rivian constructed 49,476 autos final 12 months and delivered 51,579. In 2025, the corporate expects barely fewer deliveries, projecting between 46,000 and 51,000 resulting from exterior elements, together with altering authorities insurance policies. It additionally expects decrease EDV deliveries for Amazon after larger output in This fall.

| Q1 2024 | Q2 2024 | Q3 2024 | This fall 2024 | Full-Yr 2024 | 2025 steering | |

| Deliveries | 13,588 | 13,790 | 10,018 | 14,183 | 51,579 | 46,000 – 51,000 |

| Manufacturing | 13,980 | 9,612 | 13,157 | 12,727 | 49,476 | N/A |

Some Wall St analysts are additionally involved about coverage adjustments beneath the Trump Administration. On Monday, Financial institution of America analysts downgraded Rivian inventory to an Underperform score from Impartial following its This fall outcomes.

The analysts additionally reduce Rivian’s inventory worth goal to $10 from $13, saying the 2025 supply forecast was “softer than anticipated” and “there could possibly be extra draw back threat if coverage adjustments are enacted.”

Rivian inventory hit with a downgrade after This fall earnings

Financial institution of America warned that new competitors from Lucid (LCID), GM’s Chevy, and VW’s Scout may impression gross sales projections over the following few years.

In the meantime, the memo did say Rivian remains to be “one of the vital viable” EV startups and the three way partnership with Volkswagen is “complicating earnings forecasts for a minimum of the following 4 years” for forecasting. Rivian finalized its EV three way partnership with VW within the fourth quarter, price as much as $5.8 billion, of which Rivian will get $3.5 billion over the following few years.

A part of Rivian’s decrease 2025 supply forecast is because of plant upgrades coming on the finish of the 12 months for its extra reasonably priced R2 SUV. Beginning at $45,000, the R2 shall be practically half the price of the present R1S and R1T.

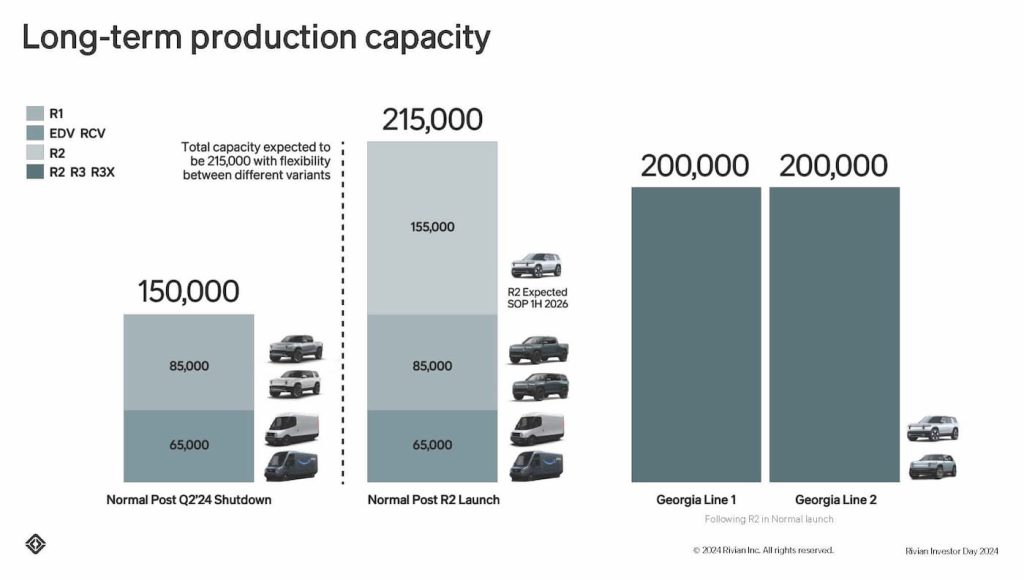

Rivian plans to start R2 manufacturing early subsequent 12 months in Regular however expects output to considerably ramp up at its new EV plant in Georgia.

Regardless of closing on its mortgage settlement for the US DOE for as much as $6.6 billion final month, the funding is up within the air with Trump threatening to freeze federal loans.

“Given the Trump Administration’s deal with cost-cutting, we imagine there could possibly be a threat to RIVN’s $6.6 billion Division of Vitality mortgage closed by the Biden Administration on Jan 16,” Financial institution of America analysts stated.

Regardless of the downgrade, a number of analysts upgraded the inventory. Needham raised its worth goal from $14 to $17, whereas Wells Fargo bumped theirs as much as $14 from $11 with an “Equal-Weight” score.

Rivian’s inventory was down over 8% on Monday following the downgrade. At round $11.90, nevertheless, Rivian shares are nonetheless up 11% over the previous 12 months.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.